In Arizona, 2017 data revealed that 750,000 people, or 1 in 10, lacked insurance. However, by 2020, changes to the Affordable Care Act provided Arizonans with better coverage options and greater stability.

Further benefiting Arizonans, most can also access federal subsidies. In fact, 84% of residents qualify, and 48% can receive cost-sharing reductions. With the right plan and subsidy amount, your monthly premiums could decrease to almost nothing.

And for those not receiving subsidies, we offer a variety of insurance options, including short-term plans. Fortunately, in Arizona, residents can choose their insurance approach without the concern of penalties for being uninsured.

Three Arizona Medical Insurance Plans

Many Arizonans get their health insurance through their employers, making employer-sponsored plans a primary source of coverage. However, people without job-based insurance often turn to the Affordable Care Act / Obamacare plans in Arizona.

Additionally, government programs like Medicaid/CHIPhave increased in popularity. Enrollments grew by 42% in 2018, showing how important they are for low-income families to get affordable health insurance.

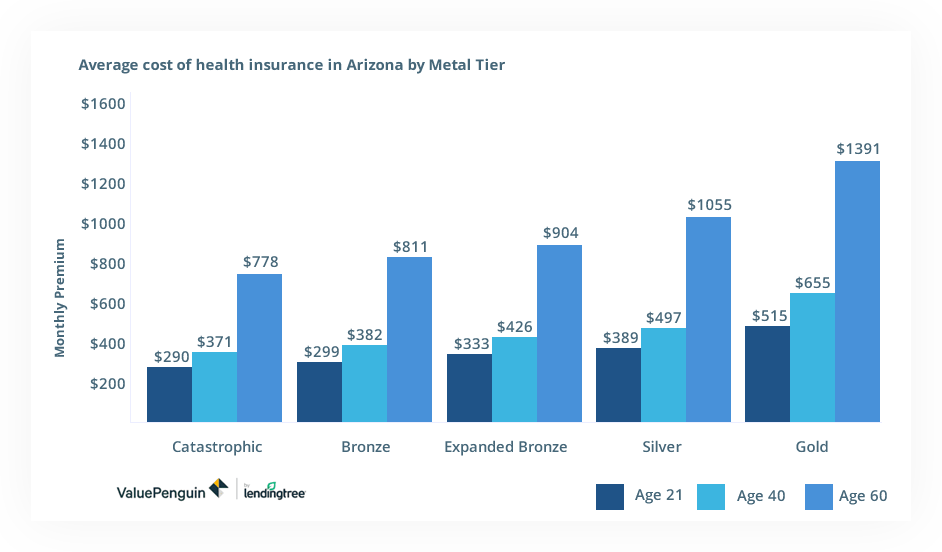

Average Cost of Health Insurance in Arizona by Age and Metal Tier

Individual health insurance has become more affordable over time. In 2020, a Silver plan cost 40-year-olds an average of $497 per month, 13% less than in 2018. However, age affects costs; a 60-year-old might pay over double what a 40-year-old pays for the same plan.

Cheapest Health insurance plans in Arizona include five metal tiers:

Arizona Health Insurance Plans Fit for Your Needs and Budget

-

Gold plans

Have the highest premiums but come with fewer unexpected costs. These plans are, on average, 35% more expensive than Silver plans. Those with high expected medical expenses or needing ongoing prescriptions will find Gold plans most cost-effective.

-

Silver plans

Are a balance between Gold and Bronze plans, offering reasonable monthly fees and manageable costs when you need care. They also qualify for cost-sharing subsidies, benefiting many households not eligible for Medicaid.

-

Expanded Bronze plans

Often referred to as extended Bronze plans, they cover 56% to 65% of medical costs. Despite this variation, premiums stay consistent with standard Bronze plans, marking them as a lower-tier option.

-

Bronze plans

Ideal for those with minimal medical expenses, Bronze plans offer coverage for occasional out-of-pocket costs. If you face large medical bills, such as an accident, Bronze plans give coverage with lower monthly fees.

-

Catastrophic plans

Similar to Bronze in cost structure, offers lower premiums but higher out-of-pocket costs. Only individuals under 30 can enroll in them.

Am I Eligible for Arizona’s Health Insurance Premium Tax Credit Benefits?

Alongside federal subsidies, the Arizona Department of Revenue offers two provisions for tax credit benefits. One pertaining to small businesses with 2 to 25 employees allows them to receive a tax credit for health insurance.

The second is even more beneficial to individuals. The ADOR grants Certificates of Eligibility for health insurance premium tax credit benefits to individual applicants who meet the following criteria:

- Earn less than 250% of the federal poverty level

- Be a legal Arizona resident (and a U.S. citizen or a legal resident alien)

- Not receive coverage by a health insurance policy for at least six months before Certificate application

- Not be enrolled in AHCCCS, Medicaid, or any other government-sponsored health insurance program

A 'family' includes an adult and their spouse for this tax benefit. You can also include unmarried children under 19. However, if these children are students, they can be part of the family definition until they're 25 years old.

| Family Size | Federal Poverty Guideline Gross Yearly Income | Maximum Income to be Eligible for Certificate |

| 1 | $12,140 | $30,349 |

| 2 | $16,460 | $41,149 |

| 3 | $20,780 | $51,949 |

| 4 | $25,100 | $62,749 |

| 5 | $29,420 | $73,549 |

| 6 | $33,740 | $84,349 |

| 7 | $38,060 | $95,149 |

| 8 | $42,380 | $105,949 |

| Over 8, add per child | +$4,320 | +$10,799 |

Under this tax benefit, “family” means an adult and spouse, an adult, spouse, and unmarried dependent children under 19 (or 25, if a student), or an adult and their unmarried dependent children (or 25, if a student).

Short-term Health Insurance in Arizona

In Arizona, the marketplace is the top choice for high-quality health insurance. However, the state also provides options like best private health insurance arizona. Short-term plans issued on September 1, 2024, will be limited to total durations of no more than four months, including renewals.

Furthermore, Private health insurance is a good choice, especially for healthy individuals. While they might not cover pregnancy, mental health, or previous health conditions, they are a reliable alternative. And now, in Arizona, Health Savings Account (HSA) compatible plans are available for short-term coverage, giving you even more flexibility.

Applying For AHCCCS Health Insurance in Arizona

A significant option for those in Arizona state health insurance coverage is the medical assistance program.

This program, known actively in Arizona as AHCCCS or “Arizona Health Care Cost Containment System.” supports thousands of Arizonans annually. With AHCCCS, eligible individuals can access doctor visits, physicals, emergency care, prescriptions, and maternity care.

Under AHCCCS, Arizona residents have several healthcare plans to pick from. However, there are specific criteria to qualify for AHCCCS, including:

-

Income

-

Arizona residency

-

Pregnancy

-

Citizenship and qualified non-citizen status

Arizona's Children's Health Insurance Program (CHIP)

Arizona calls its CHIP program "KidsCare." It provides essential medical services for eligible children under 18 at reduced costs. While monthly fees apply, they're just $50 for one child or $70 for a whole family, no matter how many children.

KidsCare Premium Amounts

| Household Size | Monthly Income Less Than or Equal to 150% FPL | Monthly Income Greater Than 150% But Less Than or Equal to 175% | Monthly Income Greater Than 175% But Less Than or Equal to 200% |

| 1 | $0.00 - $1,595.00 | $1,595.01 - $1,861.00 | $1,861.01 - $2,127.00 |

| 2 | $0.00 - $2,155.00 | $2,155.01 - $2,515.00 | $2,515.01 - $2,874.00 |

| 3 | $0.00 - $2,715.00 | $2,715.01 - $3,168.00 | $3,168.01 - $3,620.00 |

| 4 | $0.00 - $3,275.00 | $3,275.01 - $3,821.00 | $3,821.01 - $4,367.00 |

| 5 | $0.00 - $3,835.00 | $3,835.01 - $4,475.00 | $4,475.01 - $5,114.00 |

| 6 | $0.00 - $4,395.00 | $4,395.01 - $5,128.00 | $5,128.01 - $5,860.00 |

| Each Additional Member* | Add $560.00 | Add $654.00 | Add $747.00 |

| Monthly Premium Amount | One Child $10.00, More Than One Child $15.00 | One Child $40.00, More Than One Child $60.00 | One Child $50.00, More Than One hild $70.00 |

*”Each Additional Member” is an approximate amount only.

Looking to Buy Arizona Health Insurance?

Browse our selection of health insurance plans. We provide options for individuals, families, and small businesses from top Arizona insurance companies.

In Arizona, the application process varies by the type of health insurance. For AHCCCS, you apply online at the Health-e-Arizona Plus site. Plus, renewing applicants must verify their eligibility and inform of any household changes like shifts in income or marital status.

On the other hand, if you're considering the state health marketplace, you have about two months to do so. The Open Enrollment period starts on November 1st and runs through January 15th. Enroll by December 15th, and your coverage begins January 1st. However, if you sign up between December 16th and January 15th, coverage starts on February 1st.

Exploring individual Arizona health insurance plans involves personal navigation through research and options. For a smoother experience, gather these essential details:

- SSNs for everyone in the household

- Your employer’s name and address

- A record of your wages or the most recent pay stub

- Information about other forms of income, such as alimony, pension, contract work, etc.

Otherwise, if you prefer a shortcut to the lengthy research and review, consider turning to AHiX Marketplace.

At AHiX, we simplify your search for the proper medical care. Compare health plans, check subsidy eligibility, and apply easily for ACA or non-ACA plans .on our marketplace. Our easy enrollment connects you directly to carrier prices and services. Start exploring AHiX or speak with one of our specialists for more information.

Top-rated Health Insurance Companies in Arizona

In Arizona, you have several top providers to choose from. Blue Cross Blue Shield of Arizona stands out, offering affordable Silver plans in over 66% of counties. If BCBS doesn't meet your needs, consider alternatives like Cigna, United Healthcare, BannerAetna, Health Net, Oscar Health Plan, and Medica. All viable options for 2026 open enrollment.

Medicaid in Arizona

Medicaid is a crucial health insurance option in Arizona, particularly for those seeking the most affordable coverage. It covers essential medical costs, often without a monthly fee, such as doctor visits, prescriptions, and preventive care. Unlike other Health Insurance, Medicaid determines eligibility based on specific criteria, including household income, pregnancy, and disabilities.

Medicare in Arizona

Medicare, a federal health insurance program in Arizona, is a primary option for those over 65 or with certain qualifying conditions. This health insurance coverage includes hospital stays, medication provisions, and other essential healthcare services. Participants of this program often manage their healthcare costs via monthly premiums, with potential additional costs when accessing specific services

Frequently asked questions

-

How do I get free health insurance in Arizona?

In Arizona, individuals with specific income criteria can obtain free health insurance through AHiX under the Affordable Care Act plans. Additionally, a state program, Medicaid offers free health care for those who meet its specific low-income criteria.

-

What are the cheapest Silver and Gold plans in Arizona for 2026?

-

Is health insurance required in Arizona?

-

How do you get health insurance in Arizona?

-

What is the best health insurance in Arizona?

-

How much does health insurance cost in Arizona?

-

What type of health insurance marketplace does Arizona utilize?

-

When can I enroll in an ACA-compliant plan in Arizona?

-

What is the state of Medicare expansion in Arizona?

-

Are there health insurance resources for Arizona residents?

-

How does Arizona open enrollment health insurance work?

Find the Right Arizona Health Insurance for Low-income

If you’re trying to stay within budget while finding the right coverage, then you already know that it can be an overwhelming process. The good news is that AHiX can do the work of searching for the right plan for you. AHiX Marketplace is an affordable exchange where you can browse for qualified and non-qualified plans so you can find the right coverage at the right price. Find your new policy today.